PetroStrategies, Inc. PetroStrategies, Inc. |

||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

|

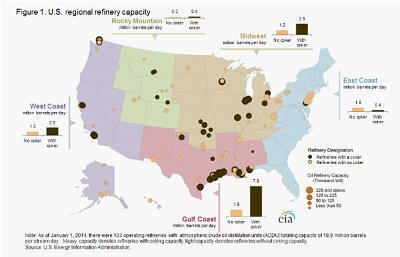

Coking Capacity, Heavy Canadian Crude Imports, and the Keystone XL Pipeline January 14, 2015 The Energy Information Administration's "This Week in Petroleum" for January 7, 2015 contained a news item entitled "Regional refinery trends continue to evolve." The article asked how US refineries might accommodate increased volumes of domestic light crude. I would suggest rephrasing the question to ask how US refineries might accommodate heavy imports of Canadian oil. Processing of heavy crude oil requires treating the heavy fractions of the crude using coking technology. The article reports, "More than 50% of the country�s refinery capacity and most of the country�s heavy crude processing capacity is located in the Gulf Coast (PADD 3)." The region has 51 refineries with a total capacity of 9.7 MMB/D. The other regions with a large amount of coking capacity are PADD's II and V.

With the increase in heavy crude oil capacity, the average API gravity of crude inputs in PADD II has decreased slightly from 33.3� API in 2010 to 32.9� API through October 2014. Imports of crude oil into the Midwest are increasing, as the region runs more Canadian crude. This trend, combined with increases in regional production, has reduced PADD II�s reliance on both US and imported crude moved by pipeline from the Gulf Coast. It seems to me that PADD II refiners should increase their coking capacity to process the heavy Canadian crude and in doing so eliminate the need for pipeline shipments of heavy oil imports from the Gulf Coast into PADD II. This also provides additional support for the Keystone XL pipeline. The emphasis for the proposed Phase 4 should not be in moving Canadian heavy oil and tight oil to PADD III but in sending the oil to, what could be, an emerging refining complex along the Great Lakes.

The EIA reports that changes in crude oil supply patterns are most pronounced in the Gulf Coast. Net imports into the region have fallen by 2.3 MMB/D, and light sweet crude imports have been essentially replaced by domestic production. From 2010 to 2014, the average API gravity of crude inputs rose by one degree. Crude oil production in PADD III has increased by 1.9 MMB/D since 2010 and receipts of crude oil (US and Canadian) from PADD II have also increased. With more Canadian and domestic barrels moving south from PADD These factors have combined to produce positive net receipts into PADD III for the first time since December 1985. Allen Mesch (Source: This Week in Petroleum - January 7, 2015, Energy Information Administration) Copyright 2014 |

||||||||||||||||||||||||||||||